Teacher paycheck calculator

A paycheck calculator allows you to quickly and accurately calculate take-home pay. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Maine Paycheck Calculator Smartasset

There are separate pay scales.

. For the example 40000 divided by 180 is 22222 a day. When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare. Calculate your Texas net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Texas paycheck.

For example if an employee earns 1500 per week the individuals annual. Texas Unemployment Insurance UI is paid on the first 9000 in wages you pay each employee every calendar year. Texas Paycheck Calculator Use ADPs Texas Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

10 month teacher salary calculator. Texas Salary Calculator for 2022. If you are a DOE-employed teacher school counselor school psychologist school social worker lab specialist lab technician school secretary or adult education teacher.

The Texas Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds. Your employer withholds a 62 Social Security tax and a. Just enter the wages tax withholdings and other.

Determine your taxable income by deducting pre-tax contributions. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. This calculator should only be used to determine the commencement salary for a classroom teacher where the period of employment commences on or after 10 July 2013.

If you are paid in part based on how many days are in each month then divide your annual salary by 365 or 366 on leap years then multiply that number by the number of days in the month. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in California. You can check your current salary using our pay scale calculator which includes the 275 per cent pay increase announced by the DfE in July 2019.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Divide the annual salary value by the total number of days in the school year to determine the daily pay rate. Your tax rate is calculated using several factors and can change each.

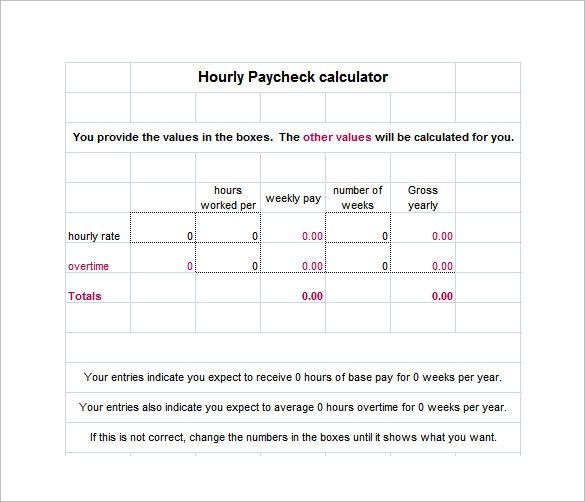

By entering your payscale point and region and factors such as pension contributions student. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Its a simple four-step process.

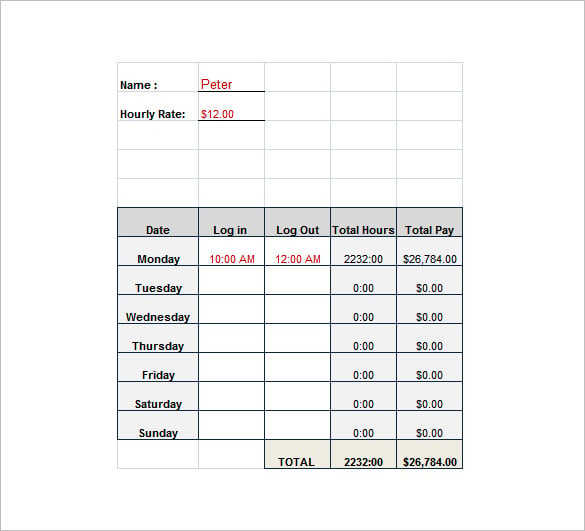

An excel spreadsheet which helps teachers to estimate their take-home pay.

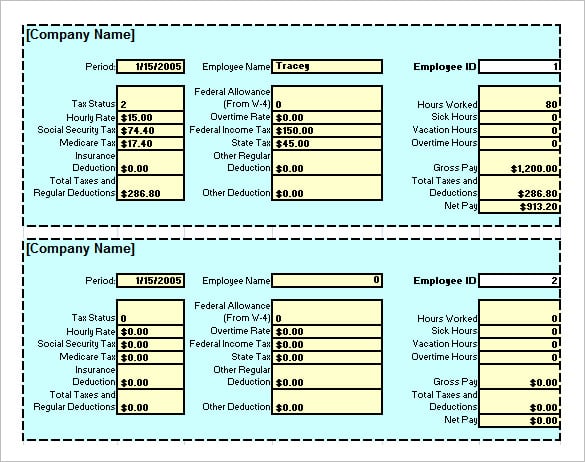

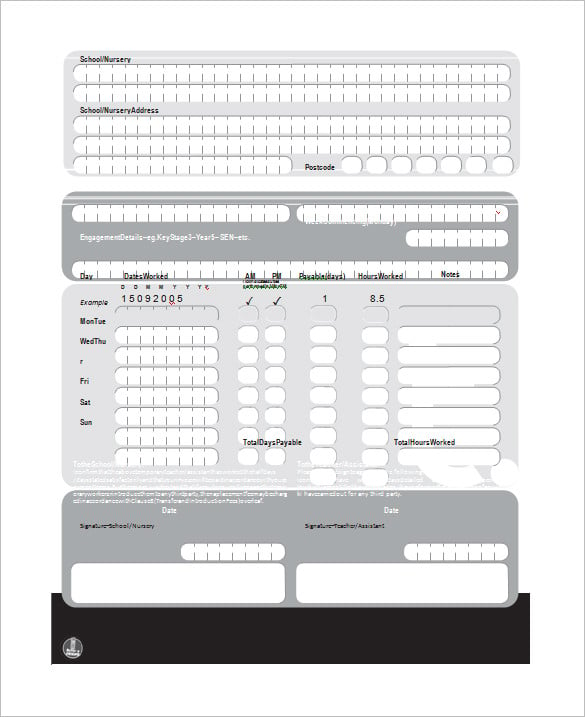

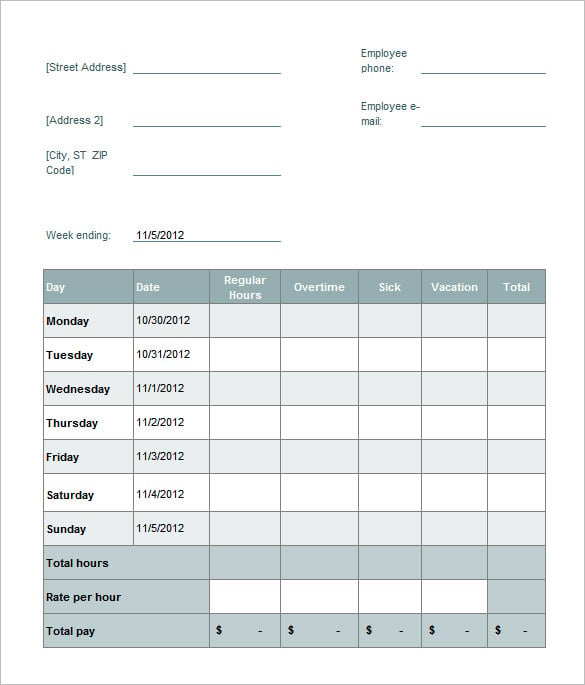

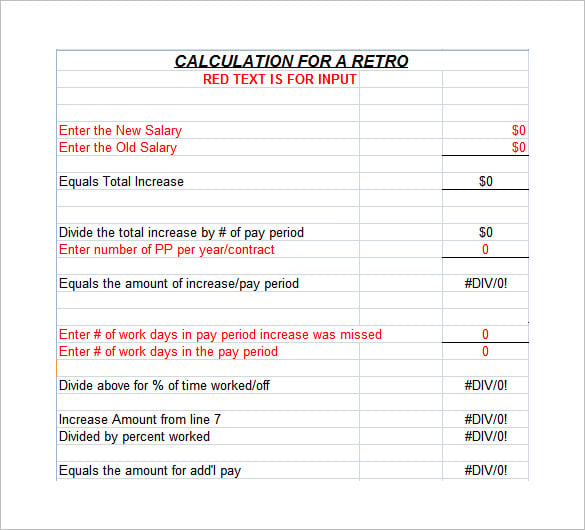

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

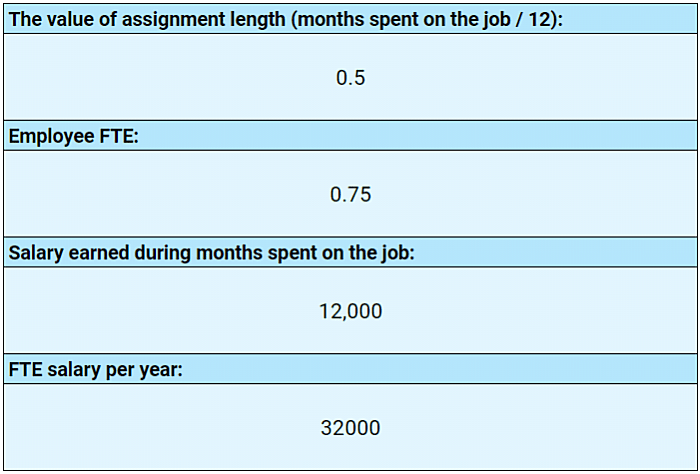

What Is Full Time Equivalent And How To Calculate It Free Fte Calculators Clockify Blog

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

California Paycheck Calculator Smartasset

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

Massachusetts Paycheck Calculator Smartasset

Calculator Teaching Resources Teachers Pay Teachers

Oregon Paycheck Calculator Smartasset

Indiana Paycheck Calculator Smartasset

Salary Calculator Spec Teach Chicago

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

The Salary Calc Online 54 Off Www Quadrantkindercentra Nl

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

The Salary Calc Online 54 Off Www Quadrantkindercentra Nl

Missouri Paycheck Calculator Smartasset